The media absolutely loves a good short squeeze. The GME short squeeze in January 2021 brought about significantly greater attention to this topic (more on that later). But what is a short squeeze fundamentally? How exactly does it work? We’ll explore and answer all of this and a whole lot more.

Let’s get into it.

What is a Short Squeeze?

Firstly what is a short squeeze?

It’s essentially a significant increase in the stock price as a direct result of excessive short selling.

If you’re not familiar with what shorting a stock means, do check out our sister article for a detailed walkthrough with examples.

In a nutshell, though, shorting a stock is the process of making money when the stock price decreases.

No, that’s not a typo. And yes, this can seem quite counterintuitive.

How can one make money if the stock price decreases?!

That’s precisely why we have a whole other article dedicated to shorting.

Now, in the context of a short squeeze, remember that this is about a significant increase in the stock price.

Short Squeeze – A Response to Shorting

The price increase is a direct result of excessive short selling.

Sometimes, investors and hedge funds see a benefit to holding short positions.

This is typically on companies that seem to be either in a downward spiral and close to bankruptcy.

Or simply, stocks that are at a low point and are unlikely to recover for quite some time.

Related Course: Investment Analysis & Portfolio Management (with Excel®)

This Article features a concept (“shorting”) that is covered extensively in our course on Investment Analysis & Portfolio Management (with Excel®).

If you’re interested in learning how to quantify risk for stocks and portfolios, working with real world data, then you should definitely check out the course.

Aggressive short selling can decrease the price of stocks dramatically.

There are many moral implications of this.

For instance, pushing a price down to 0 can mean:

- job losses,

- bad debts,

- lack of contract renewals with other (smaller) businesses, etc

If a stock’s price rises quickly and substantially, this puts a lot of pressure on short positions and may force some of them to “buy to close” their positions.

The drastic and continued increase in a stock’s price is thus called a short squeeze because it squeezes those short sellers into closing their positions.

And since a stock’s ceiling is theoretically unlimited, losses from shorting could also be theoretically unlimited.

Short squeezes are therefore a short seller’s worst nightmare.

How Does a Short Squeeze Work?

The goal of the short squeeze varies, but the ultimate goal is to force short sellers to abandon their positions and force the stock to a higher price.

The initial capital requirement is extremely high, sometimes requiring the initiating party to purchase millions of shares all at once.

Depending on the size of the company, buying millions can either make a significant impact on the price or have virtually no impact whatsoever.

The success of a short squeeze depends partly on:

- how prospective buyers view the stock, and

- how much pain short sellers can bear before being forced to sell

As more prospective buyers gain faith, they may buy shares themselves, which helps sustain the initial drive up in price.

The higher the price rises, the higher the unrealised losses become for short sellers.

When the pain becomes too unbearable, short sellers will eventually close their positions at a loss.

However, it’s important to remember that, when short sellers close their positions, they are technically buying shares back from the market.

For this reason, the act of closing a short position, in a sense, somewhat strengthens the short squeeze.

Some of those sellers might have margin requirements that result in their brokerage force-closing their short position, which continues to drive the price of a stock higher.

Want to go beyond the Short Squeeze?

Get the Investment Analysis & Portfolio Management (with Excel®) Study Pack (for FREE!).

Are There Real-World Examples of a Short Squeeze?

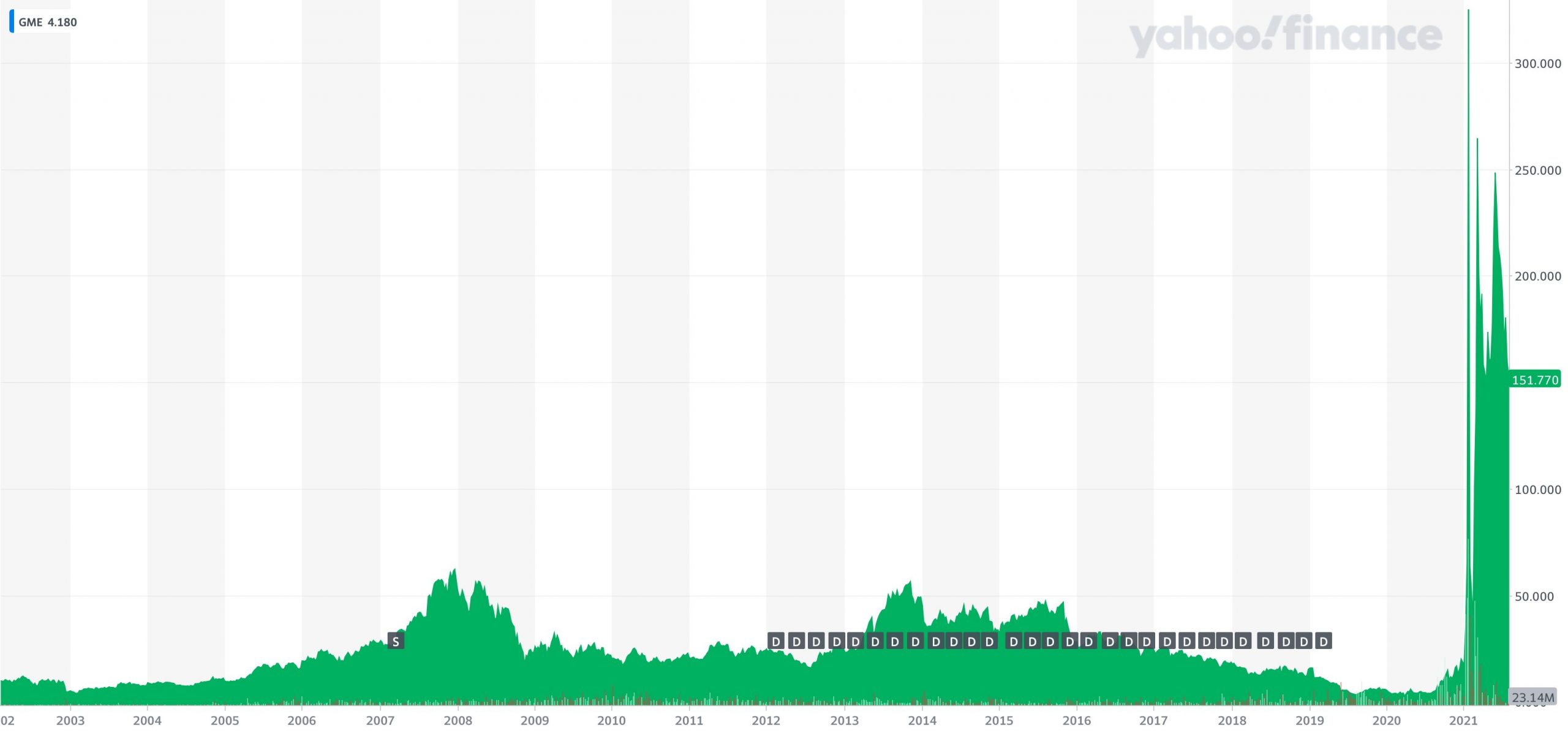

One of the most popular examples in the world of short squeezes is the GameStop fiasco earlier this year.

Long story short, a group on Reddit called /Wallstreetbets hyped up the small video game and collectible retailer’s stock on their forum.

This resulted in millions of shares getting bought by individual retail traders from a number of sources globally.

The stock started as low as $3.50 a share and ultimately rose to close to $500 per share (about $480 or so).

Yes, the chart above only displays a high price of about $325 or so, but the stock did reach highs of close to $500 during after-hours and pre-market trading.

By the way, we talk about pre-market trading in our sister article on How to Read Stock Numbers.

Anyway, the GME short squeeze famously forced a large investment firm called Melvin Capital to close out of its large GameStop short position, resulting in a 53% loss in its portfolio.

The reason for this dramatic event was mostly due to a previously unnoticed mechanism in the US system that allowed more shares to be shorted than actually existed.

When the price shot skyward, there were no shares to buy in order to close the short positions.

Thus, the price had to rise to a point where the buyers were willing to sell.

Couple that with an almost zealot-like following on Reddit to hold the shares no matter what, and the results speak for themselves.

How To Avoid Getting Trapped In a Short Squeeze

The simplest way to avoid losing in a short squeeze is to avoid shorting.

At the end of the day, shorting requires immense skill and knowledge of a particular company in order to profit.

Those just getting started in their investing journey should approach carefully, and ideally avoid it altogether.

However, there are certainly ways to learn how to do it with relative safety if you’re willing to spend some time researching.

It can lead to higher-than-normal profits but should still be approached carefully with a well-planned strategy.

If combined with a long position (i.e., if implemented as part of a hedging strategy), shorting can help decrease the risk of a position.

This is something we’ve shown in our data driven investing course wherein we ideate, formulate, create, and test a long-short investment strategy, for example.

What Happens To a Company Experiencing a Short Squeeze?

A publicly-traded company offers shares on the stock market in order to raise capital for their company.

This is done when they first offer it (during an IPO), and in additional equity offerings (e.g., rights issues, seasoned equity offerings, etc).

Short squeezes rarely affect the company for a period of time.

For reference, most short squeezes reverse after anywhere from a few minutes to a few days.

But a short squeeze can be beneficial for companies in that it can result in better capital structures.

For instance, a highly levered company can see its gearing / leverage ratio decrease as a result of a short squeeze.

Firms could also recapitalize and restructure their capital structure by paying off debt or refinancing it at a lower interest rate.

While this isn’t common with short squeezes, a fully successful short squeeze could result in elevated prices that some struggling companies can use to their advantage.

Are Short Squeezes Good or Bad?

The best answer to this is that a short squeeze is neither good nor bad.

It is simply the result of enjoying access to a free market.

While the markets may seem at times to be the realm of the rich and finance-savvy, most stock markets around the world are designed specifically to let investors engage in a free and open market that allows prices for financial assets to be whatever the market – you, me, and anyone who participates – says it should be.

While it is certainly a manipulation of stock prices, it is something that can be avoided in most cases by having more and more people involved in buying and selling shares.

You can also stay out of it by simply engaging in safer methods of investing.

Final Thoughts: What Is a Short Squeeze?

The short squeeze is when certain market participants drive buying of a particular stock in order to force short sellers to close their positions and encourage more buying of shares.

While some recent events have not been short-lived, most short squeezes are over quite quickly and reverse back to the original price.

While short squeezes are dangerous for those who hold heavy short positions, it is possible to learn to sell equities and hold short positions, even for retail investors.

It can also add a measure of diversification you may be looking for in a self-managed equity portfolio.

Related Course: Investment Analysis & Portfolio Management (with Excel®)

Do you want to leverage the power of Excel® and learn how to rigorously analyse investments and manage portfolios?

Leave a Reply

You must be logged in to post a comment.